New IMAP Partner DealHaus Positioned to Help Clients Capitalize on Dynamic Danish M&A Market

As IMAP welcomes DealHaus as its exclusive M&A partner in Denmark, Mick Ohira, Managing Partner at DealHaus, explains to IMAP what makes Denmark so attractive to investors, why its M&A market has proven so resilient to global macro-economic changes, and what key factors will be driving deal activity in 2024.

Founded on Ambition and Experience

DealHaus was founded in 2013 by Palle Nørgaard and Mick Ohira. Their ambition was to create a leading M&A advisor to middle-market business owners in Denmark. Following a succession in 2022, the advisory boutique is today owned and managed by three equity partners, managing partner, Mick Ohira, and partners Peter Schnedler and Thomas la Cour.

Moving on an Upwards Path in the Lower-Middle Market

Our eight M&A advisors are based in our offices in Copenhagen and Aarhus. We focus on the lower- and middle-market, with deal values typically ranging from €5-50 million and our clients are spread across a wide range of industries, including Technology, Professional Services, Consumer, and Industrials. With a primary focus on sell-side advisory, advising business owners (family-owned businesses, private equity funds and owner-managed), our core offering is processed advisory services, alongside sales preparations, due diligence preparations, and the coordination of vendor due diligence and similar pre-market vendor reviews of the targets. Having closed more than 30 transactions in the last five years, the partners draw on some +40 years of accumulated experience. Fulfilling our original ambition, DealHaus is now one of the top 10 leading firms in Denmark and tracking towards a goal of another year of growth.

Attractive Economy for Investors

Denmark is a very easy country to do business with and we have had a stable economy for many years. Our economy is among the very few nations in the world with a AAA/Aaa credit rating and we have one of the highest GDP’s per capita in the EU (and the world).

While a relatively small country, it has a leading business environment, ideal for capital investments. Due to its efficient and transparent regulatory environment, robust legal protections for investors, and a well-functioning judicial system, as well as streamlined processes for starting a business, obtaining necessary permits, and accessing credit, it ranks 4th globally in the latest and final World Bank "Doing Business" report.

Furthermore, our society is highly digitized, and the workforce here is generally comfortable with English as a corporate language, which means it’s fairly easy to communicate with organizations here making it an approachable landscape for entrepreneurs and corporations. And, although we boast a number very large companies with leading positions in their industry globally (including Maersk, Novo Nordisk, Lego, Danfoss, Pandora, and more), most of the businesses in Denmark are small and mid-sized family-owned businesses. We have very few companies that grow large, so there can be a lot of latent growth potential hidden in the mid-market businesses for international investors.

Growing and Robust M&A Market

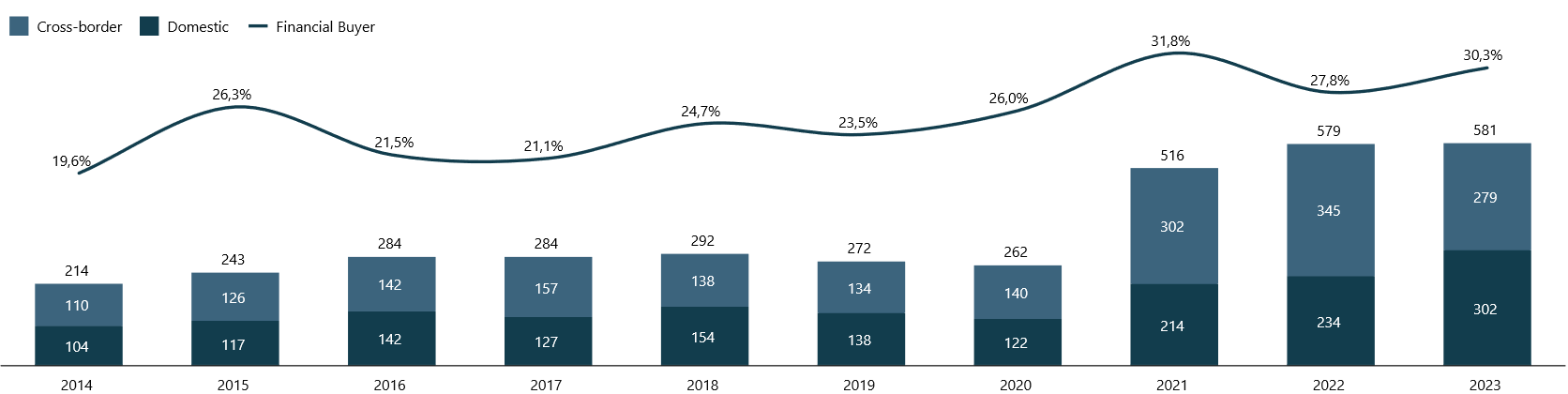

Our mid and lower-mid M&A market is growing and so far, showing solid momentum, having proven to be very resilient to global macroeconomic changes. In 2023 581 transactions with a Danish target were announced, above pre-COVID levels and just slightly more than 2022 numbers, which was one of Denmark’s record years in terms of deal activity.

Despite the global macro-economic challenges, high inflation and rising interest rates, the Danish M&A market has fared well. And while we suspect there is a significant number of deals which were completed in 2023 due to delays from 2022, the numbers clearly demonstrate that there is still momentum in the Danish market.

Looking closer at the figures, domestic deal volume was proportionally more in 2023 than in 2022. From the 581 deals registered, approximately 52% of the deals had a Danish buyer, comparable to 40% the previous year. The reason for the trend towards more domestic deals may be in part be found in the macro-economic turbulence and increased focus on own domestic markets – but with deal volume being driven largely from smaller and lower-mid market targets, another reason could be that these were more suitable for domestic acquirers.

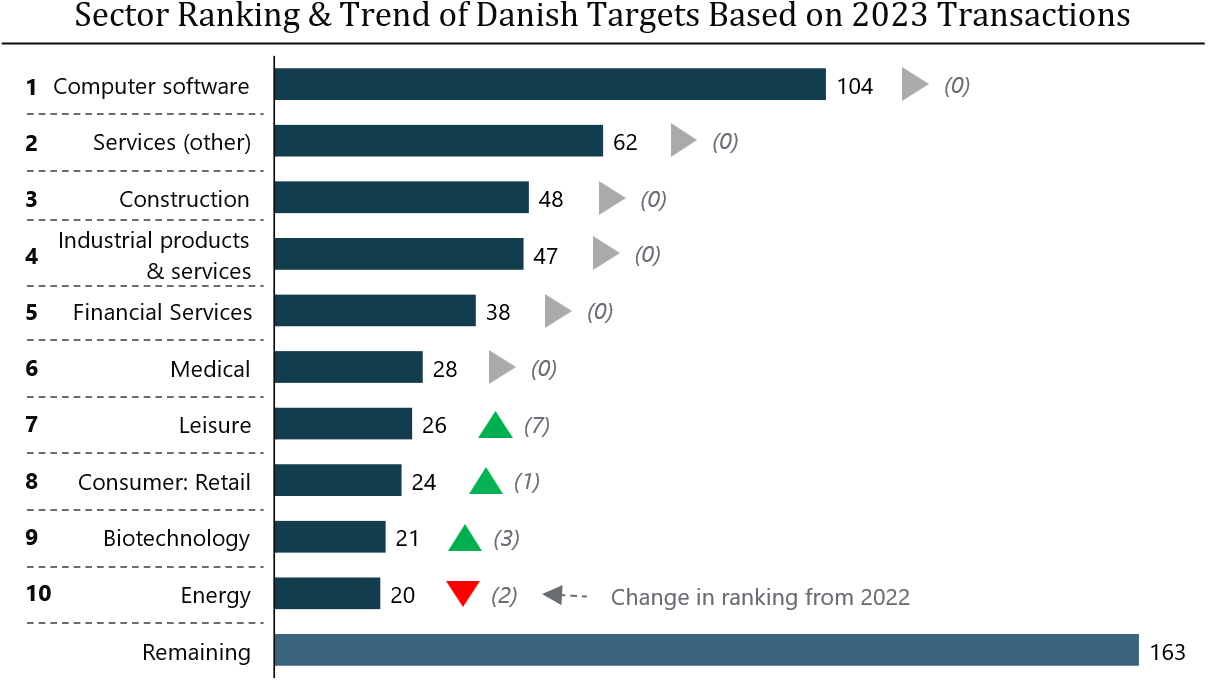

On a sector level though, there were significantly more cross border deals with a target in Industrials (~62%), Leisure (~58%), Biotechnology (~67%), and Energy (55%), while on the opposite end of the spectrum Retail reported only 29,2% cross border deals in 2023.

Software was the preferred sector for financial sponsors, accounting for 36,8% (down from 38,5% in 2022) of all deals with a financial sponsor involved as a buyer. Leisure and Biotechnology followed each with 11,1% (1,7% and 7,7% respectively the previous year), and Industrials with 9,4% (12,8%).

This shift towards domestic transactions in Denmark's M&A landscape, alongside the enduring appeal of certain sectors for cross-border deals, exemplifies a strategic adaptation to the current economic climate. The Software sector, while declining slightly, continues to attract significant interest from financial sponsors, underscoring its ongoing relevance. Industrials, although experiencing a slight dip in cross-border interest, remains a crucial sector. These trends collectively paint a picture of a dynamic, responsive Danish M&A market, adept at navigating both domestic and international waters amidst fluctuating economic conditions.

There are several key trends we see that are driving the robustness of the Danish market:

- Sector-driven acquisitions

- Financial sponsors

- Cross-border activity

- Succession

Sector-driven Acquisitions

There are many underlying local sector conditions that support M&A as an attractive strategy. We have identified several key sectors that offer promising opportunities, even in challenging economic conditions:

- Technology: This is by far the best performing sector in terms of deal volume as demand for technology companies remains extremely strong

- Professional Services: We expect to see more activity from both strategic and financial buyers, as well as lots of interesting opportunities arising in the years to come

- Public Sector: We have a large public sector in Denmark which collaborates closely with private businesses. Even in challenging economic conditions these businesses fare well, so we see the potential for this to become an increasingly attractive sector for investors

Financial Sponsors

The Danish M&A landscape is witnessing a remarkable surge in interest from financial sponsors. This heightened activity registered in recent years is fuelled by the substantial 'dry powder' available evidenced by 30% of our transactions involving a financial buyer, mirroring the broader market trend. In recent years we have witnessed significant capital inflows, with record-sized funds being raised, indicating a robust and dynamic market.

Notable financial sponsors are raising, or have already successfully raised, new funds since the beginning of 2023, and this is expected to drive activity in the years to come. Just some examples include:

- Axcel: VII fund focusing on mid-market companies

- GRO Capital: EUR 600 million Fund III closed in early 2022

- Erhvervsinvest: DKK 1,1 billion fund V closed in July 2022

- Capidea: DKK 1,25 billion small- and medium cap fund closed in March 2023

Several other financial sponsors have also announced that they are raising new funds, and new entrants from geographies such as Benelux and the Nordics are adding to the momentum created in the M&A market by this segment.

Cross-border Activity

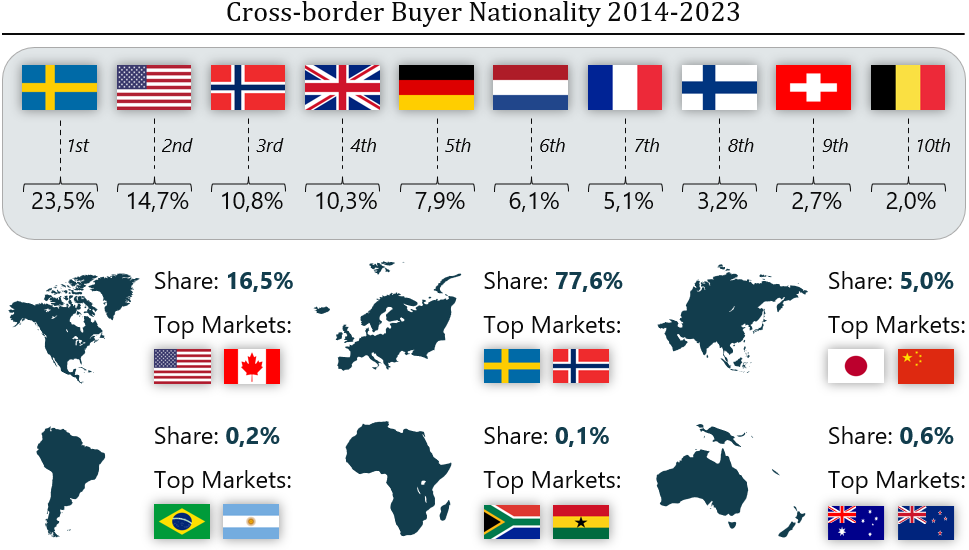

Demand from foreign buyers and investors in Danish business remains strong, with Europeans buyers showing a growing interest in Danish companies leading to an increase in inbound transactions - which is good news for buyers and sellers alike. Cross-border deals accounted for approximately half the of the deals closed in Denmark in 2023.

We believe this is likely to be a key driver of M&A in Denmark moving forward, as more and more international buyers look to Denmark for potential sector-specific acquisitions where we have some very interesting targets available.

Approximately 40% of the deals we close are with a foreign counterpart, so being able to navigate the complexities of cross-border transactions is key. Moreover, almost entirely all processes will include relevant foreign prospective buyers. Therefore, throughout the last 10 years we have invested heavily in building relationships with dealmakers, professional buyers, and large corporates in key markets around Denmark. However, we have learnt that what’s most important, is having relationships with dealmakers in the markets of your counterpart as cultural differences and language barriers can be a challenge, creating friction or misunderstandings. Also, when it comes to launching a new mandate, building up a strong list of potential buyers improves the success rate tremendously. So, when screening international markets for key candidates, we again rely on local partners. Furthermore, being aware of buyer interest in foreign markets, changes in conditions, and trends is very difficult, so we use the local knowledge of our partners in the key geographies that we expect could be relevant to our client’s business.

Almost all our clients’ businesses are relevant to an international audience, so being part of a strong global partnership is key to both our and our client’s success in an M&A process which is really one of the key reasons we became an IMAP partner as we admired not only the strong brand, as one of the top 10 middle-market M&A advisories in the world, but we were impressed with its global presence, with coverage in 49 countries.

Succession

As with many other economies, Denmark is anticipating a large wave of successions within family-owned businesses in the coming years. The emphasis on exit strategies in small- and medium-sized businesses is being prioritized in board rooms, and succession within the owner-family is no longer the default strategy. Thus, the current wave of successions in Denmark is likely to maintain, if not enhance, the already active Danish M&A market, with an emphasis on innovative, adaptable sectors and mid-market deals.

Key Focus Areas for Danish Buyers in 2024

The direction of the M&A landscape in 2024 remains to be determined, but we are experiencing high demand for our services. Furthermore, demand for quality companies remains unchanged. So, while the overarching macro-environment will definitely be a defining factor, we are optimistic for deal activity this year.

DealHaus - IMAP Denmark a Cut Above the Rest

In an industry as competitive as M&A advisory, our methodology has been developed with one thing in mind; to create value for our client. We have a very hands-on approach and we always run processes with two senior (partners) dealmakers and a deal team. Because of this approach, we can optimally leverage the skillset and knowledge within our company, and not only are we able to achieve the hard and soft goals of our clients, but equally important, we develop a close relationship with them.

We have also invested significantly in new software solutions that enable us to do the work better and more efficiently, so we can dedicate our time to advising our clients throughout the process.

Now a distinguished player in the market, our ambition remains the same as our founder’s; to be the preferred partner and advisor to entrepreneurs, active investors, and family offices or large corporates and with the collaboration and support of the many industry specialists and dealmakers in IMAP, we will further strengthen our offering and deal opportunities in our market.

Mick Ohira is the Managing Partner of DealHaus, which he has been a part of since the company was founded in 2012. Over the years, he has advised in many transactions across industries and company sizes and is a specialist in ICT and e-commerce. With a career that started in a Big Four accounting firm and the experience of helping to build DealHaus over the past 10 years, Mick has an entrepreneurial yet structured approach to his advice to business owners in medium and small businesses. Mick holds a master's degree in Finance and International Business as well as an HD in accounting from Aarhus University.